I married my best friend and the love of my life, Elizabeth, in March of this year (2023). Our wedding marks the beginning of an exciting new life chapter for us.

It also marks our journey into one of the greatest wealth hacks around: Marriage.

This post explores the tax benefits of marriage that go beyond the power of love and forever partnership.

“How Will Marriage Affect My Taxes?”

In short, it should help reduce the total tax burden between the two of you for three key reasons:

- Your tax brackets are larger when married

- You get two standard deductions when married

- Your combined expenses and cash flow allow greater opportunity for tax-smart savings

If your eyes are already glazing over, hang in there. Let’s discuss some background.

How To Leverage Bigger Tax Brackets in Marriage for Tax Savings

The United States operates on a progressive tax system, which means not every dollar we earn is taxed the same as the last. The more we make, the greater the tax rate we pay on our last dollar earned.

The amount of dollars subject to each progressive tax rate is defined by “tax brackets.” The lowest bracket starts at 10% for lower taxable income amounts and rises to 37% for the highest earners.

The size of these tax brackets differs for individuals filing alone and married couples filing together. Married couples, comprised of two “individuals,” enjoy larger tax brackets, which can help result in a lower tax burden.

Notice in the graphic above, tax brackets for a married couple are roughly twice as large as for an individual.

- As an individual, your first $11,000 in taxable income is taxed at 10%.

- As a married couple, that 10% bracket extends to $22,000 of your taxable income.

This pattern carries on up the brackets as you compare Individual and Married tax rates. You can think of a “Married Filing Jointly” (MFJ) tax return as a way to combine your two, smaller individual sets of tax brackets.

So where are the savings?

You may think: well, we had two incomes before we got married and we have two incomes now, so how will this play out any differently if the brackets and our incomes are combined?

In almost all cases, those two incomes won’t be identical. That fact makes it possible for more of your combined income to be taxed at the lower brackets.

Here’s an Example of How This Works

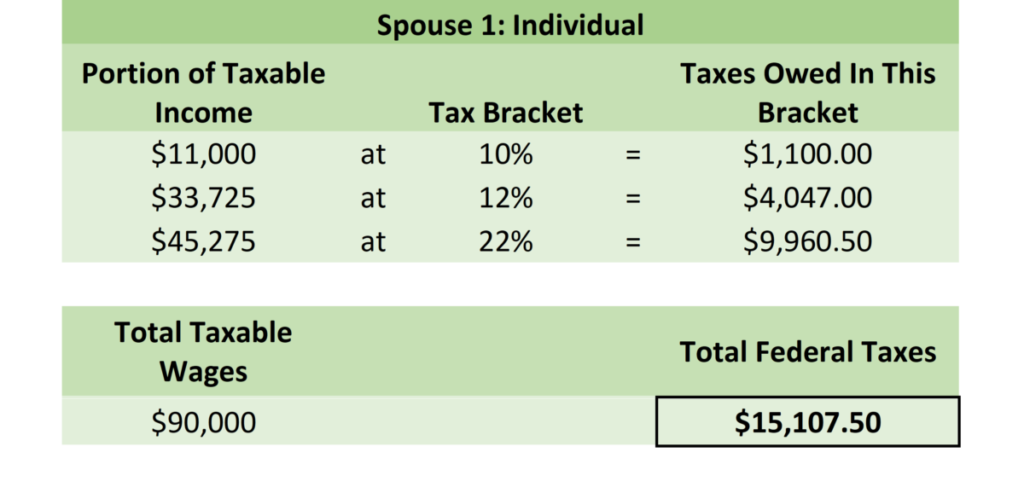

Spouse 1 Earns $90,000 in taxable wages after the standard deduction of $13,850.

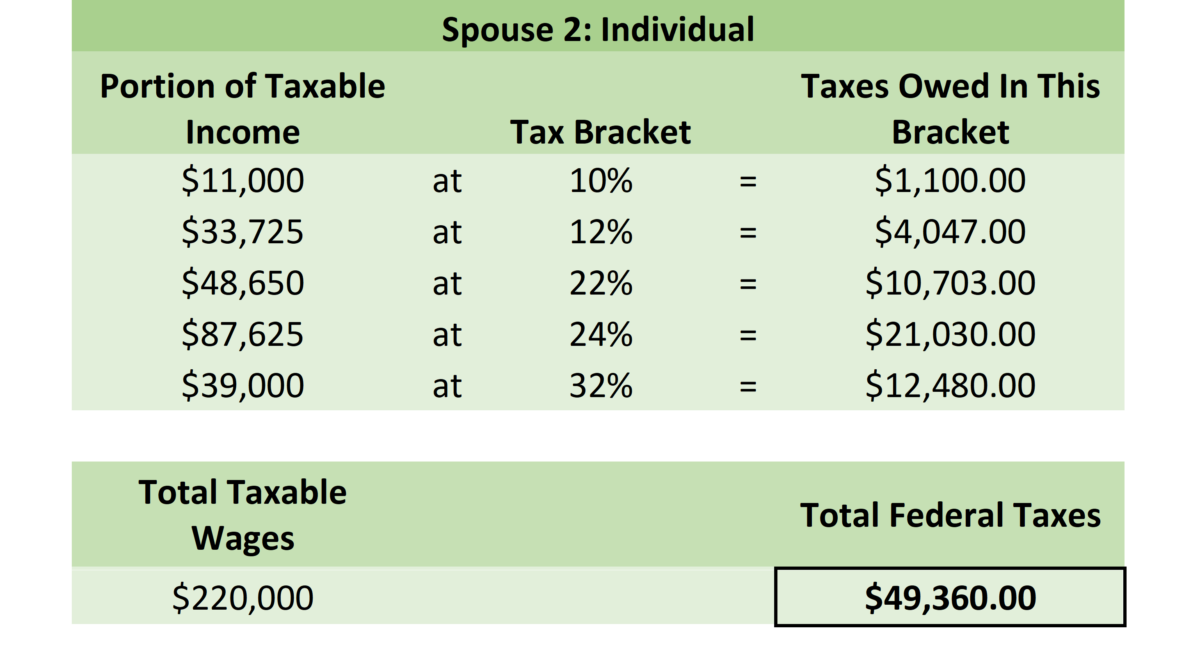

Spouse 2 Earns $220,000 in taxable wages after the standard deduction of $13,850.

Filing Individually

Spouse 1, if filing an individual return, would land in the 22% tax bracket and would owe about $15,108 in federal taxes.

Spouse 2, filing an individual return, would land well into the 32% bracket and owe $49,360 in federal taxes.

Total combined federal taxes when filing individually: $64,467.50

Filing Together

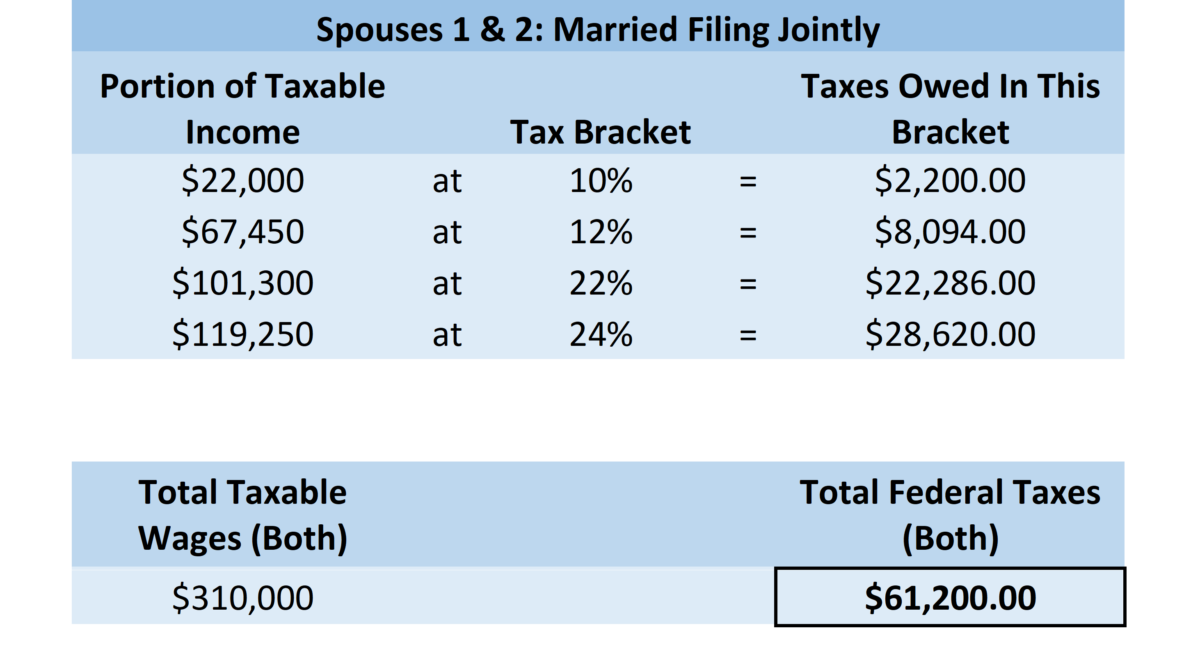

Spouses 1 and 2, if filing a “married filing jointly” (MFJ) return, land squarely in the 24% bracket.

Total combined federal taxes as Married Filing Jointly: $61,200.00

Tax Savings: $3,247.50

This results in over $3,000 in tax savings.

Why does this happen?

When the two spouses were filing individually, Spouse 1 landed in the 22% bracket, but didn’t “use” up the whole bracket. That bracket would have allowed for an additional $48,100 in taxable income taxed at that 22% rate. However, as an individual, Spouse 1 had no other income to include.

Meanwhile, Spouse 2’s income blew past the 22% and 24% tax brackets on their individual return, pushing them well into the 32% bracket.

When the couple filed their MFJ return together and the brackets were effectively shared, Spouse 2’s excess income was able to fall into the now larger, lower shared tax brackets.

This reduced the overall tax bill and placed their combined income in the 24% tax bracket, with no dollars taxed at 32% (a big improvement from how Spouse 2 was taxed individually).

Who does this impact the most?

This feature of marriage has the greatest impact on couples with greater disparities in income.

Single income households will notice the biggest relative shift in their taxes.

What do you need to do to make this happen?

Nothing, aside from filing a joint return, starting with the tax return for the tax year in which you were married.

Note: Your tax withholding won’t automatically change at work once you’re married, so be sure to file an updated IRS Form W-4 after the marriage to let payroll know of your tax status change.

How You Can Benefit From Double the Standard Deduction With A Joint Return

The individual standard deduction for 2023 is $13,850.

This means as an individual, if you earn $100,000, $13,850 is removed from your taxable income (now $86,150) before taxes are calculated.

For married couples, that deduction is doubled – $27,700.

This means for a married couple earnings $100,000 together, the taxable income base is $72,300, resulting in a lower tax bill.

Now in many cases, you’ll also be combining two incomes.

- In the event you’re combining two incomes each greater than the individual standard deduction amount of $13,850, there are no savings here for you.

- There is, however, at least $1,385 tax savings here for new one-income households filing together for the first time.

- If at any point in the future, a two-income household goes down to a one-income household, rest assured this doubled Standard Deduction amount is benefitting your tax bill.

How Combined Expenses and Income Create More Tax Savings Opportunities

Saving to a traditional IRA or pre-tax 401k is a way to further reduce taxable income in the present year while stowing money away for retirement.

In another article, we talk about deciding between making a Roth vs. a Pre-Tax Retirement Contribution.

Finding the space in cash flow for this kind of saving can be challenging for individuals solely responsible for all the essentials like housing, groceries, utilities and transportation.

When joining forces with another in marriage, typically, each person’s cost of life’s essentials falls:

- You share housing

- You can share utilities like cell phone bills for discounts

- You now only need one bottle of ketchup instead of two

These reduced per-person costs create an opportunity for increased savings with your merged incomes. When done in a smart way, you can build flexibility for tomorrow and reduce your lifetime tax burden at the same time.

Action Items:

- Set a time with your spouse to walk through your financial pictures together.

- Sketch a plan of what cash flow could look once the two pictures are joined and discuss what priorities you have for your joined cash flow.

“If you don’t tell your dollars where to go, you’ll wonder where they went.”

One of the greatest gifts a new couple can give one another is healthy communication and process around managing household finances. If you have any questions or don’t know where to start, let us know how we can help.