In the world of retirement contributions, many say the Roth is king.

The Roth is a fantastic tool for building tax-free wealth. It’s also a great way to pass wealth to the next generation.

Both Roth and Pre-Tax accounts have their time to shine.

Playing the contribution game wisely across your lifetime has a material impact on what’s left in your pocket along the way.

The challenge?

For one, your life and the tax code are evolving all the time.

Secondly, choosing between Roth and Pre-Tax involves a process for evaluating what’s true today while making a few intelligent assumptions about what your income will look like in the future.

This post simplifies and exemplifies how to make the right choice for you.

We’ll unpack the following questions (tap any question to jump ahead):

What’s the difference between Pre-Tax (AKA Traditional) and Roth contributions to a 401k?

When should I make a Pre-Tax contribution to my 401k?

When should I make a Roth contribution to my 401k?

Why does Roth vs. Pre-Tax matter and what complexities do I need to watch for?

What’s the difference between Roth and Pre-Tax (or traditional) contributions?

Traditional (Pre-tax) Contributions:

• With a Traditional retirement account, you contribute the money before your taxes are calculated. This drops your taxable income by the amount of your contribution.

• Example: You earn $100,000, you contribute $6,500, $93,500 remains taxable. That $6,500 can grow tax-deferred, meaning you’ll pay taxes later when you withdraw it for spending.

• This approach saves you tax dollars today, with an agreement to pay taxes later.

Roth Contributions:

• Roth retirement accounts work a little differently. You contribute after-tax dollars, or in other words, you still pay taxes on that contribution amount today.

• You earn $100,000, you contribute $6,500, $100,000 remains taxable. The trade-off? That $6,500 can grow tax-free forever.

• This approach can save you on taxes later by paying them at a lower rate today.

When should I make a Pre-Tax (or Traditional) contribution?

Pre-Tax is generally the winner in the following scenario:

Current Income Tax Bracket: Higher than you think it will be later on when withdrawing the money

Future Income Tax Bracket: Lower when withdrawing the money than your current bracket is today

Our Objective:

We want the tax break at the highest relative tax bracket moment for us

because this saves us the most money across our lifetime.

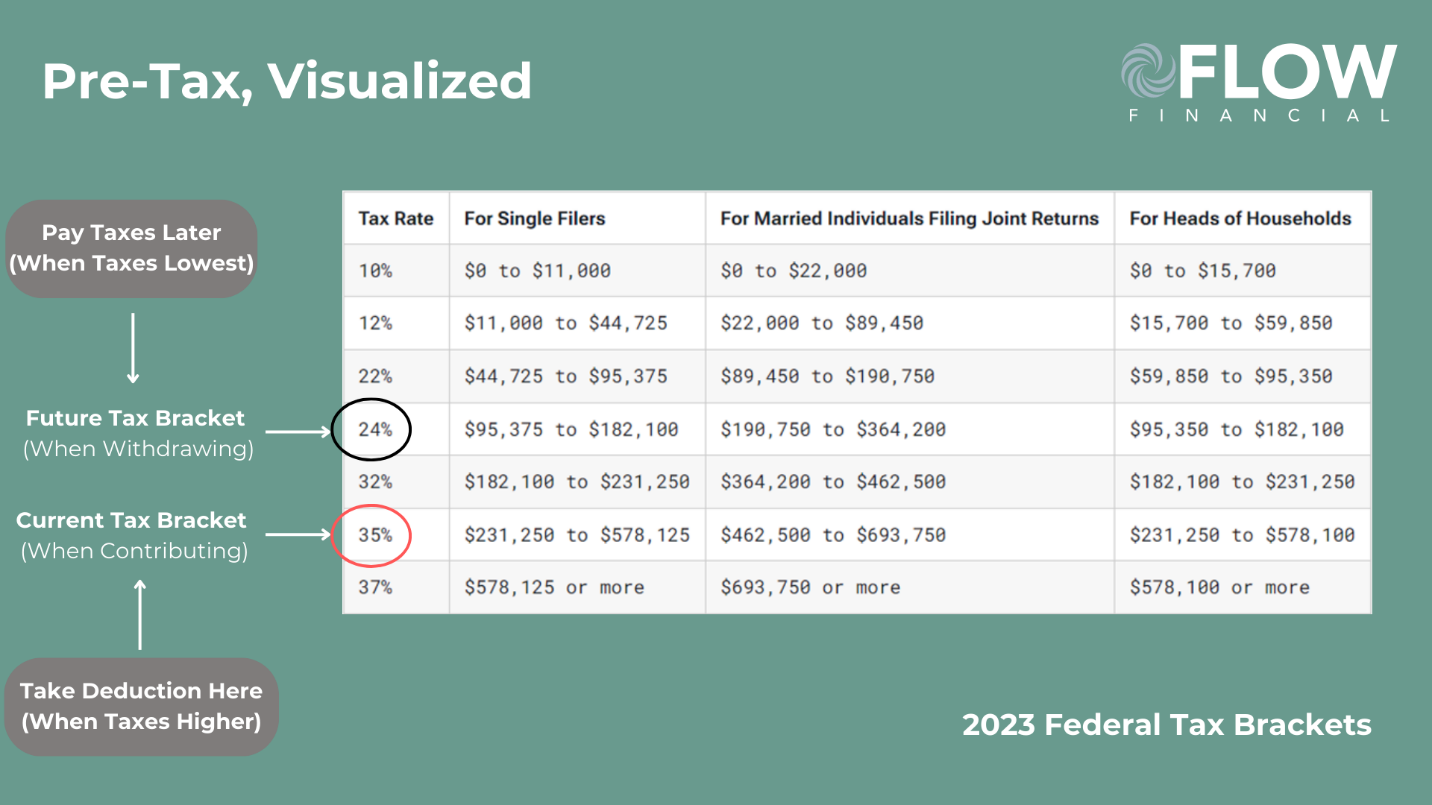

(Open this image in a new tab to view a larger version)

Let’s look at a case example:

Case One (Pre-Tax)

Situation:

- Married couple, Leo and Jen, aged 57 and 54, earn a combined $600,000 in taxable income each year from all sources.

- They aim to retire in their early 60s.

- They realize they’re currently in the midst of their highest earning years.

- They suspect that once they quit work, their base income each year will be much lower – placing them in a lower tax bracket than the one they occupy now.

Contribution Analysis:

- At their current level of income, Leo and Jen are squarely in the 35% federal tax bracket.

- They think later on their combined income from Social Security and retirement accounts to support their lifestyle will total about $225.000 in today’s dollars.

- This would place them in 24% bracket at that time, based on current tax law.

Given that their income is probably about as high as it ever will be going forward, the Pre-Tax option looks like the right way to go.

- Doing so will save them 35% in taxes today.

- The trade off: they agree to pay taxes later on as they withdraw money from the account, at presumably the 24% tax bracket.

The net impact of tax smart-saving here: 11% in this case, based on their income timeline.

On a $30,000 contribution each, during peak earning years, that’s $6,600 saved in today’s dollars, each year. Not bad for some fairly simple, smart planning.

When should I make a Roth contribution?

Here’s the general situation in which the Roth emerges the winner:

Current Income Tax Bracket: Lower today while contributing the money than it will be later when withdrawing

Future Income Tax Bracket: Higher when withdrawing the money than it is today

Our Objective (Reminder):

We want the tax break at the highest relative tax bracket moment for us

because this saves us the most money across our lifetime.

(Open this image in a new tab to view a larger version)

Here’s a case example for this, using a younger version of Jen and Leo.

Case Two (Roth)

Situation:

- Back when Jen and Leo were 31 and 28, they didn’t earn as much as they do now.

- Their combined household taxable income was about $140,000 in today’s dollars, which landed them in the 22% tax bracket.

- They both knew they had high-earning-potential careers, yet – those higher earnings were waiting for them many years ahead, suggesting they’re occupying a relatively low tax bracket today.

Contribution Analysis:

- By making Roth contributions, Leo and Jen paid taxes as they made contributions at the 22% tax bracket.

- The trade-off for paying taxes early: they ensured they’d never pay taxes on those dollars again – even if those dollars were in investments that grew significantly over the next 40+ years.

In the Pre-Tax example, we established that Leo and Jen would likely be in the 24% tax bracket when pulling money from their accounts in retirement.

By paying at 22% ahead of time, during the right years, they save a net 2% in taxes.

Big whoop, right? That 2% savings occurs, theoretically, for many years, though. That adds up with time.

Why does Roth vs. Pre-Tax matter and what complexities do I need to watch for?

The cases in this post are about as simple as they come with it comes to the Pre-Tax vs. Roth decision. Many Do-It-Yourselfers who feel these cases represent the complexity of their picture will dominate this decision without any help.

They’ll likely be OK following this standard rule of thumb (standard, but not perfect):

Make less money early in your career, Roth.

Make more money later in career, Pre-Tax.

There are a few harder questions that muddy this up:

When is the turning point when the switch needs to be flipped between the two options?

What is the impact of the following common factors on the best option?

- Real estate income

- Side-gigs

- Inheritances

- Business sales

- Trust Income

- Charitable Intentions

It is definitely possible, that by making the wrong decision between Roth and Pre-Tax contributions, someone can unknowingly volunteer to pay MORE in taxes.

- If you make Pre-Tax contributions during the wrong years, you may be taking deferring taxes at a low rate so you can pay at a higher rate later.

- Flip that around for the Roth option and have a similar, undesired result: paying taxes today at a higher rate in exchange for a free pass on taxes at a low rate in the future.

As the years go on, Return on Effort is a metric I pay much more attention to than I used to. Math matters, but it does not determine all.

Regarding the effort involved for managing this question:

A simple discussion or routine to gather reasonable assumptions about this can push the needle towards the best answer each year. Software and tools certainly help visualize a path to the right answer. For many, they may not be necessary. For others, it’s the only way to create a confident strategy.

Regarding the math:

If…

Average working life is 40 years

Average per-person contribution is $15,000 annually ($30,000 per couple)

Then this post’s imaginary case example of many 2% net tax savings years and 11% net tax savings really starts to add up.

If those savings make into your portfolio, now you’re saving like a pro.

This is just one of many areas in which I see greater opportunity for clients of all income levels.

As the complexity and income of your situation rises, so do the stakes and potential rewards of handling it optimally.

My mission is to help clients navigate these types of questions with only as much attention from them as is necessary to make the best decision.

Having a proactive system to address these items is a big aid in that effort.

In the end, the more you can simplify your processes for making great financial decisions while still ensuring you’re making them correctly – the more you’ll enjoy the ride.

That’s life in Flow.

Disclaimer: Remember, this is just general education with imaginary cases. The examples mean to help you digest the potential impact of tax-smart savings, but they do not illustrate what your unique experience will be based on your income story across your lifetime. Tax-planning, in general, presents wothwhile opportunities for a great many individuals and families when done skillfully. Working with a financial planning and/or tax advisor will help you identify and implement the best tax-strategy for your unique situation.