This blog post digs into something we all experience but may not fully understand – tax withholding and tax refunds. Here are the questions we’ll answer:

How is my tax withholding determined?

What happens if my tax withholding is too much or too little?

Why is a large refund a sign of a missed opportunity?

How can I calculate and adjust my withholding?

What is tax withholding?

When it comes to the withholding basics, you probably know the drill.

Throughout the year, as you earn income, your employer withholds a portion of your paycheck for taxes. That portion goes straight to the federal government (and state, if applicable), lessening your take home pay.

When withholding is set properly, this process ensures that come tax season, you’re not hit with a massive tax bill nor any penalties for underpaying throughout the year.

When you get a big tax refund, it usually means that your withheld taxes were greater than the amount you owed for your income. The money you receive from the IRS is actually your own, which they are simply giving back to you.

“How is my tax withholding determined?”

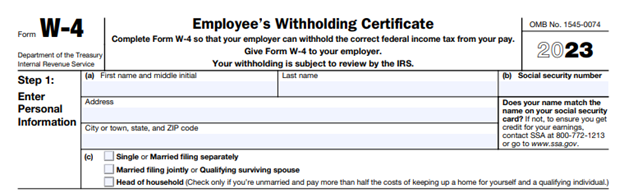

The last time you started a new job, they probably slapped an IRS Form W-4 in front of you.

The W-4 indicates to your employer:

- Your filing status

- The number of dependents that will be listed on your return

- Income from other jobs

- Other deductions you expect to claim

- Any additional withholding you’ve requested

Based on your W-4 information, your employer calculates and withholds federal and state taxes.

More deductions and dependents listed on the W-4 = less tax withholding throughout the year.

Note: Be careful, manipulating this form isn’t a way to “owe” less taxes in the end. It’s just a way to adjust the amount of taxes you’re paying automatically with each paycheck. If you underpay, you could end up with penalties for paying the taxes “late.”

Whenever you want to make adjustments to withholding, the W-4 is the way to make it happen.

“What happens if my withholding is too much or too little?”

For most, they only find out how much they’ve over or underpaid when they file taxes each year.

If you’ve overpaid, you’ll receive a tax refund.

If you’ve underpaid, you’ll owe the balance and, in most cases, an additional penalty for paying them late.

Ouch. So, the “overpay and take a refund later” approach seems safer. Right?

The answer is probably “yes” for those who feel overwhelmed by taxes on their own and want to err conservatively.

But opting for big refunds each year may be a missed opportunity.

“Why is a large refund a sign of a missed opportunity?”

Sure – it’s fun to get a big chunk of cash as a reward for filing your taxes. It may feel like a bonus.

But what does a huge refund actually tell us?

A big refund indicates that you overpaid taxes throughout the year. Your prize? The IRS sat on those extra funds at 0% interest to you. Even your “insert major bank name” checking account is paying more than 0%.

That extra cash you lent the IRS can be put to work earning interest, funding investments, or having fun.

For example, Bankrate is showing that many high-yield savings accounts are offering almost 5% in annual interest on deposits.

If your refund was $5,000, that’s $250 of interest you could be earning for just parking that cash somewhere else.

For you over-achievers, this offers an opportunity for optimization.

“How Can I Calculate and Adjust My Withholding?”

The IRS provides a Withholding Calculator that will help you figure where your current withholding will land you with regards to refunds when you file your next tax return.

It takes maybe 15-20 minutes to work through.

Steps for using the IRS Tax Withholding Estimator:

- Gather your last tax return, recent paystubs for the household and notes on retirement account contributions for the current tax year.

- Walk through the questions of the withholding calculation tool. Don’t forget to include estimated investment income.

- When you’re finished, you’ll see a breakdown of expected total taxes paid versus owed, and your anticipated refund or deficit.

- You’ll also see a slide-bar for desired refund (pictured below), which will generate action-steps for your situation based on what you want your refund to be.

- If you scroll down further, you can print a more detailed report of your tax picture.

Use these new insights to complete a new IRS Form W-4, and give it to your employer (or whomever handles payroll for your employer). Often times, payroll can help you with basic questions, too.

Once processed, you’ll notice an adjustment in your withholding, allowing you to put the extra cash to work.

If you’re feeling uneasy about taxes and making adjustments, it may be time to talk to a tax or financial planning professional. Reach out if we can help.